We've been long on Paypal for quite a while and we're back with an adjusted price target thanks to this really wild volatility season.

Paypal smashed through our first two price targets before hitting the same brick wall the rest of the market did in late 2021. Some companies deserved to have their valuations compressed like this, but we're of the view that Paypal still has a compelling case for growth.

Paypal is maintaining its strong growth compared to the underlying e-commerce industry, and even though their management team reduced guidance for this year, they are pushing towards long-term consumer growth that should help them recover fast even in this volatile market.

Paypal stock is trading at a price-to-earnings multiple of 26x right now, which may as well be a different universe compared to their high of 57x earnings. Paypal is looking more and more like a value play.

Let’s get into it 👇

Paypal ($PYPL) Overview:

So, the major reason Paypal is down 12% on the week leading up to this post is that PYPL management released reduced revenue guidance during their Q1 earnings call a few weeks back. Basically, management came out and said that the company would be growing revenue at a slower rate than they predicted before.

This combined with the rest of the NASDAQ selling off to crush PYPL's valuation down to current levels.

This looks like a classic case of a stock getting oversold. But reducing guidance like this was probably a solid move by management to get out ahead of a potentially choppy market. However, the fundamentals here are still strong, which opens up a long term value play for Paypal investors.

Revenue Growth Slowed:

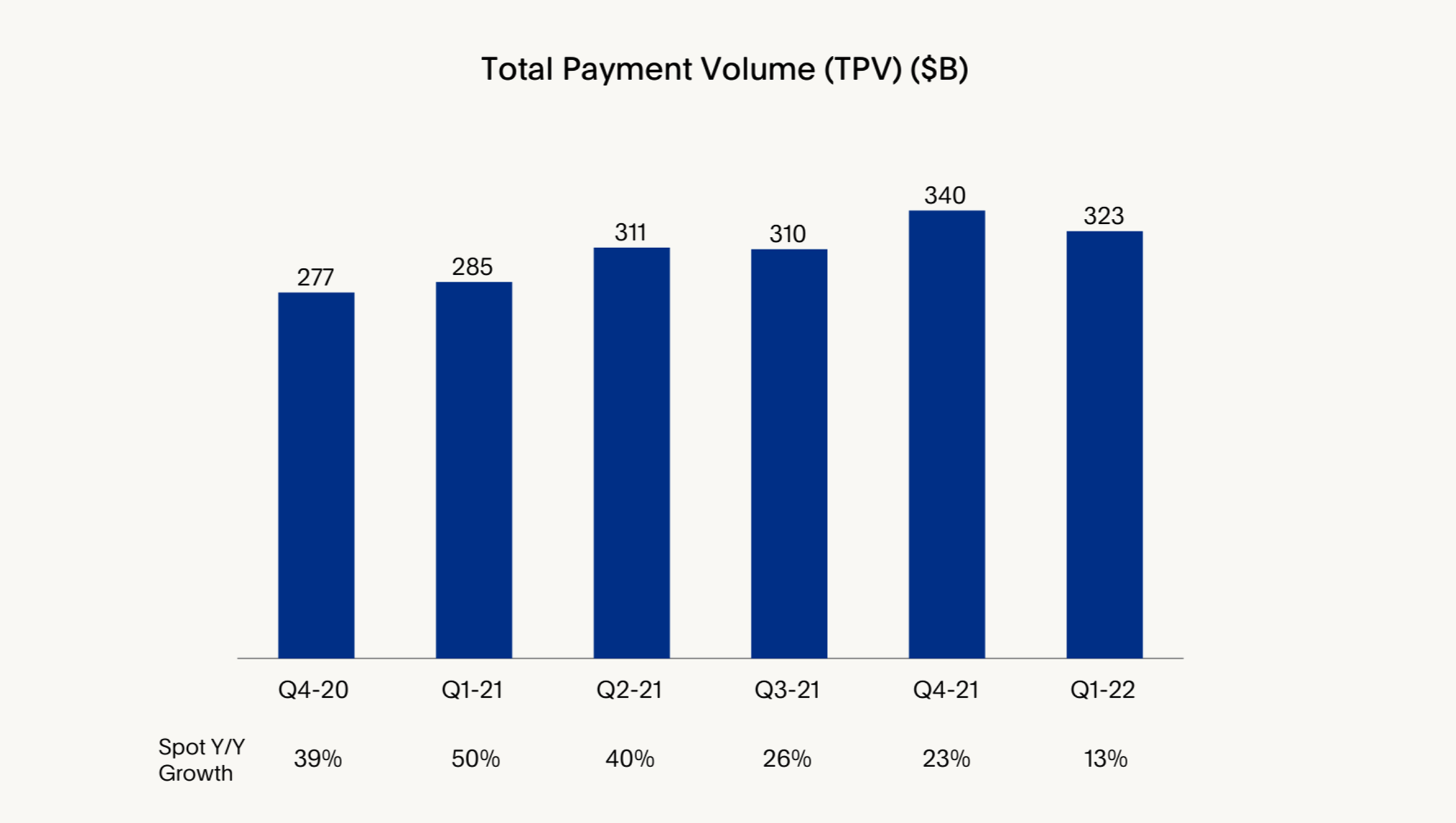

So, a chart like this can spook investors in a volatile market as it turns more and more bearish:

The key number here is that Spot Y/Y Growth metric on the bottom. Basically, Paypal only managed to grow payments 13% in Q1 2022 compared to Q1 2021. This is the first time in a while that number has even dipped below 20% for Paypal.

But that dip makes sense because growth in 2021 was unprecedented for e-commerce. E-commerce basically was the economy from 2020 to mid-2021. We're only just now seeing in-store retail sales recover at the expense of e-commerce revenue.

Meanwhile, even in an environment where Paypal ended it's partnership with eBay and e-commerce as a whole was cooling off, Paypal managed to add customers:

The number of accounts is up at Paypal, the transactions-per-account is up too. Paypal has managed to use all the data they've gathered to lock in a really solid product that makes buying and selling things online (and in-store) really easy.

This is the kind of growth you need to maintain long-term value, especially in an environment where the market is turning more bearish.

The metric that gives us the most confidence is their cash-on-hand though. Paypal has $4.9 Billion on their balance sheet and a solid debt-to-equity ratio of 50%. This means that unlike other growth plays that might be way over-leveraged, Paypal has a LOT of room to improve its product or attract new customers if organic growth gets dicey.

Paypal can take a punch, which is not something a lot of fintech companies can say right now. The amount of money that flows through Paypal's infrastructure is wild as well:

$1.5 Trillion flowed through Paypal in 2021, netting them $25 billion in revenue. This is a great product, and we're really excited to see the suite they add onto their recent Buy-Now-Pay-Later play as well as their crypto trading platform. Paypal certainly has the cash to make improvements and the right leadership to pick winning improvements.

What's Next For The Stock:

Q4 2022 is going to be critical for Paypal as that's the e-commerce super bowl (heck, it's the most important quarter for the whole economy).

If the Fed can help inflation to peak without landing us in too heavy of a recession, Paypal and the rest of e-commerce will skyrocket. Paypal has the ability to weather a harder landing as well, given how much cash and how little debt they have.

But the TLDR of this post is that PYPL is the cheapest it's ever been compared to the S&P 500. It's a brilliant product that can maintain normal growth in a cooling economy. That alone justifies a bull case in our view.

While it'll likely continue being "stuck" in the near term, over the longer term we see this as a tremendous upside play.

Price Target: $95 (28% upside)

Current Price: $74

Target Date: Q1 2023

Rating: Overweight

Risk/Reward: Medium-High / High

Ticker: PYPL

Market Cap: $85B

Dividend Yield: N/A