Travel is back! A few weeks ago, our favorite airline, Delta Airlines ($DAL), held an investor day that basically proved our entire 2023 thesis a few quarters early.

Delta has smashed through our initial price target and all our wildest expectations as high-income passengers flood back to the airline.

With their Q2 guidance extended further, our team thinks it's really important to lock in our price target now -- which is a few days before their highly anticipated Q2 earnings report that gets released on Thursday.

If Delta even comes close to their Q2 guidance for profitability, right as the peak travel season kicks off, the stock could get heavily overbought -- pricing us out of a solid runup through October.

So, let's lock in a strong position now while we can! Gear up for a little more mania as the travel industry hits way sunnier skies in the back half of 2023.

In short, Delta's revenue and profitability are soaring on the back of solid demand and premium tickets.

High-income travelers don't care about inflation, they're simply trying to get back out in the world as we push toward recovery. And Delta already has strong numbers for Q3 even though we're barely a week into this new quarter.

If Delta can maintain these levels, they will make a solid run at their all-time highs from 2019 across the next year and a half.

Even with flight disruptions marring the July 4th travel season, Delta is on pace to be one of the best businesses winning the travel recovery.

The details practically write themselves here, so let's take a quick dive into the numbers, and see where we're projecting the stock to go next 👇

Delta Update:

Delta's run in the last month is simple enough to figure out. First, the market kept seeing positive travel trends and consistently added to the stock.

And then, Delta's investor day boosted their EPS guidance to a range of $2.25-$2.50 per share, up from a max of $2.25 before. This essentially cemented Delta as a leader in the travel recovery and sent the stock rocketing past our price target.

But we need a lot more than that to re-up our coverage on this side of their earnings report, so what else has us bullish here?

There's a lot, but let's go down the major highlights:

-

Demand has essentially recovered. The decline of the aviation industry across the past three years has been defined by a collapse in demand and soaring costs. While inflation slowly got more and more under control, we've still had a lot of questions about where demand is and where it's going from here. Delta essentially put all those worries to bed by demonstrating how flight demand has reached a level that brings them back to historical norms.

-

The chart below is also a really handy guide to better understand just how bad the airline industry has been -- going from the COVID crisis to the inflation crisis. What a brutal 1-2 punch! But also what an incredible turnaround. Also, note that this turnaround actually was ahead of the curve last year, but fuel costs were too big an impediment to overcome.

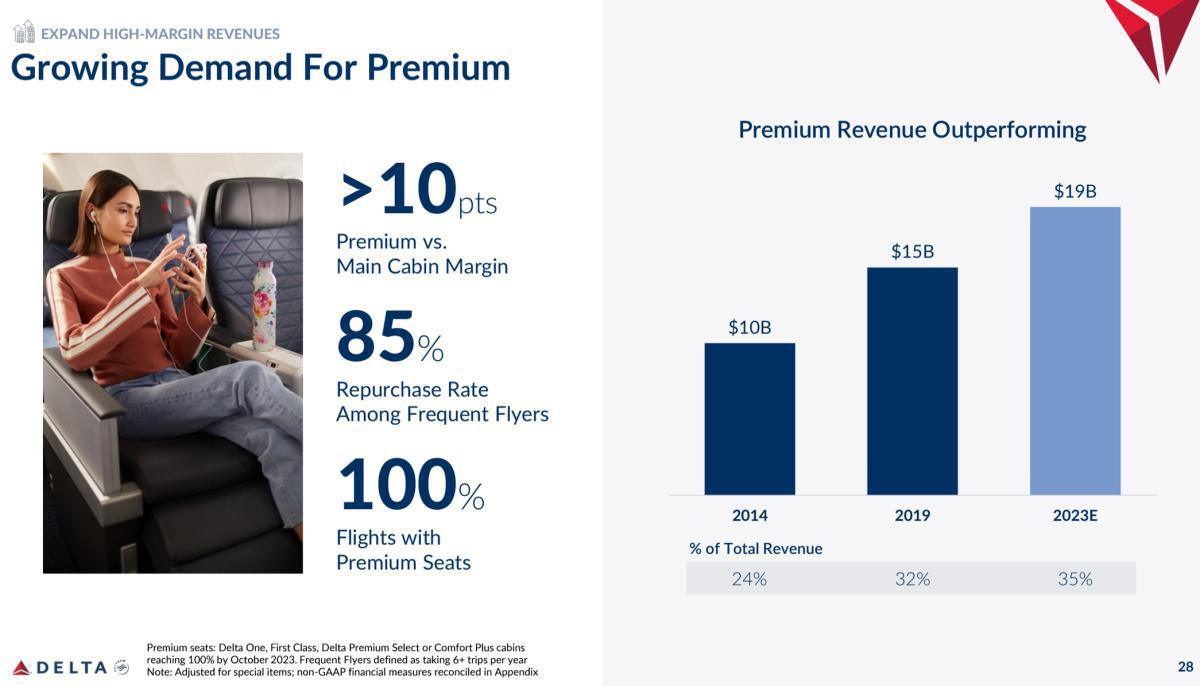

- Delta is shifting to an inflation-proof consumer base. We've talked to death about how inflation across the past year has created parallel economies wherein higher-income folks won't shift their spending as much as average consumers. Travel brands have taken this to heart and the true winners are offering as many perks as possible to get a more consistent, harder-to-hurt, consumer base on their flights. After last month's investor day presentation, we are a lot more confident that Delta is one of the major winners pushing premium folks into their funnel. Premium tickets are everything. They pay more per flight, have higher margins per flight, and tend to be more loyal once they lock in a brand experience they enjoy. This is going to make Delta a lot stickier and their revenue gains last longer than the summer peak we're currently pushing through. These percentages are great to see considering that you only need to win these kinds of passengers once before you can consistently keep them in your funnel.

- Loyalty programs are off the charts. And the last part of our premium travel thesis is already proving out with Delta loyalty programs starting to hit a huge inflection point. More loyalty leads to higher, recurring revenue and better margins as those rewards get doled out in consistent, predictable ways. This really is the trifecta when it comes to being successful as a travel brand during this new paradigm in 2023.

Delta Outlook:

And that's basically all we need to put in a new price target ahead of earnings this week. Our analyst team wants to be really clear in stating that, since Moby takes a multi-year view on investing, our PT is actually a little more conservative than others.

We need to make sure we're pricing in any uncertainty moving forward as OPEC+ is still fighting hard to put pressure on energy costs and lots of other black swan events could be hanging over the consumer economy.

Regardless, Delta's transformation into a brand that can win in 2023 makes them a brand that can win in any economy.

We love the growth we've seen from DAL and this foundation makes us genuinely confident they can push even higher from here.

The summer of travel is in full swing, and we're simply ecstatic to watch Delta reap the benefits.

Price Target: $58 (21% upside)

Current Price: $48

Target Date: Q3 2024

Stock: Delta Airlines ($DAL)

Rating: Overweight

Risk/Reward: Medium/ Medium-High

Market Cap: $31B

Dividend Yield: .83%