This period of inflation and downturn is genuinely bizarre and far more complicated than it seems. Because of that, certain companies have a surprisingly high probability of doing very well even if inflation hasn’t peaked with the near-historic 9.1% rise in prices we saw reported last week.

Of all of those companies, the biggest surprise is Visa ($V), whose fundamentals look strong enough to thrive across the back half of 2022.

Usually, payments companies get hurt badly in an environment of inflation and potential downturn. But the way inflation is affecting consumers worldwide doesn’t impact Visa’s biggest consumer base.

Furthermore, Visa stands to benefit further as worldwide travel kicks back off despite continued COVID fears.

All of these, combined with Visa adding new products, features, and technologies that are expanding its TAM, add up to the payments titan thriving in most of the circumstances where this economy can take us.

Let’s get into it below! 👇

Visa ($V) Overview:

Visa is the #1 payments company on Earth and one of those classic blue-chip stocks that’s usually a no-brainer value pick.

But with the stock dragged down 14% from its all-time high last year, this moment a week before their Q2 earnings call on July 27th, feels like a solid defensive buying opportunity.

Visa is one of those really hard-to-disrupt companies that’s adapted and grown really well despite a quick-shifting fintech landscape.

Let’s get into the factors that are keeping Visa strong even in this market.

Inflation Isn’t Hurting Visa Badly:

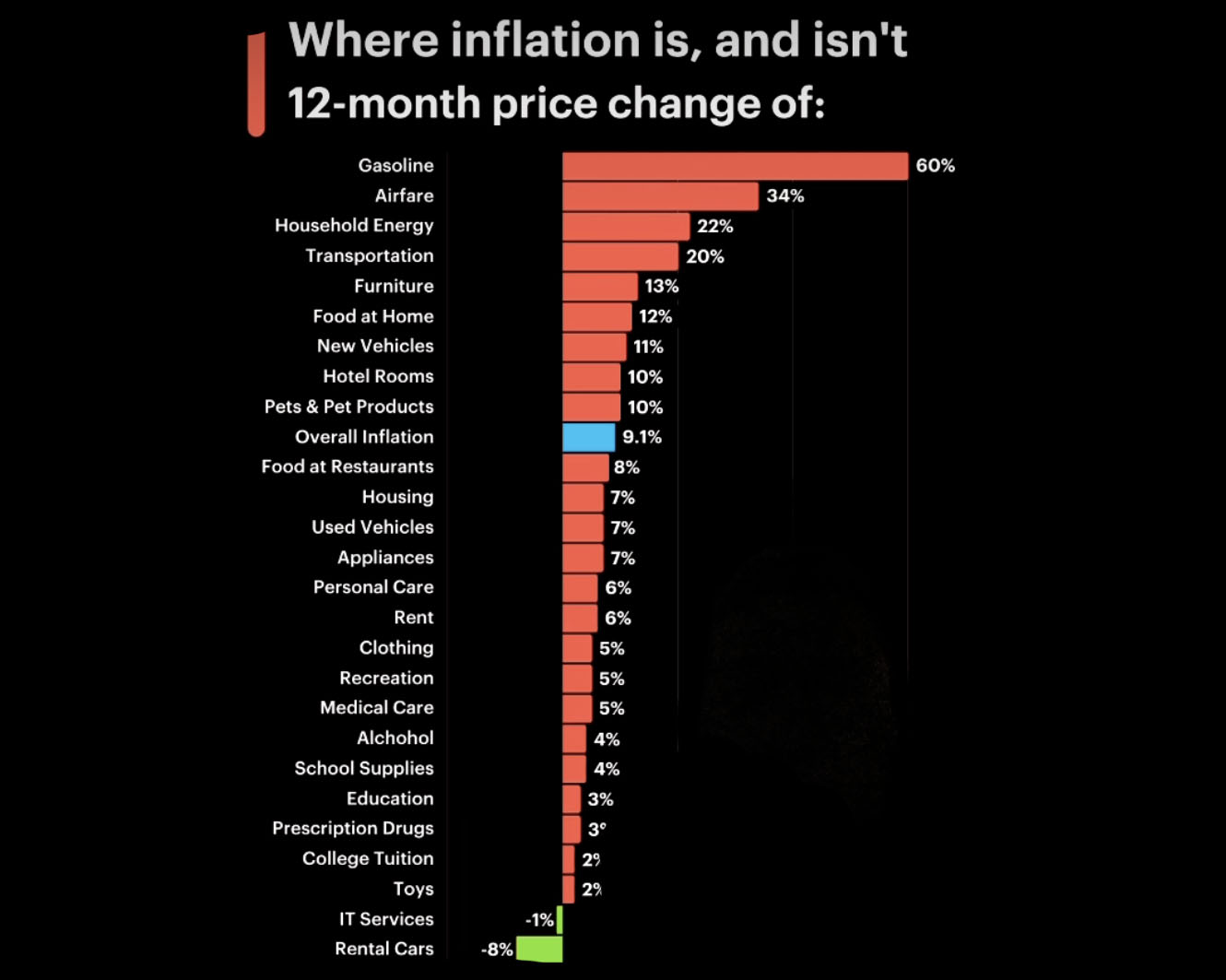

It’s hard talking about our current inflation because there’s so much noise and not much signal. But we can use the latest CPI breakdown to understand what’s happening:

The main driver for inflation is obviously gas prices. But look how that trickles down.

Inflation is only looking broad base because all of our necessities are being made more expensive by energy prices.

A payments processing company like Visa is more sensitive to broader consumer spending though. So the important chart is the next one:

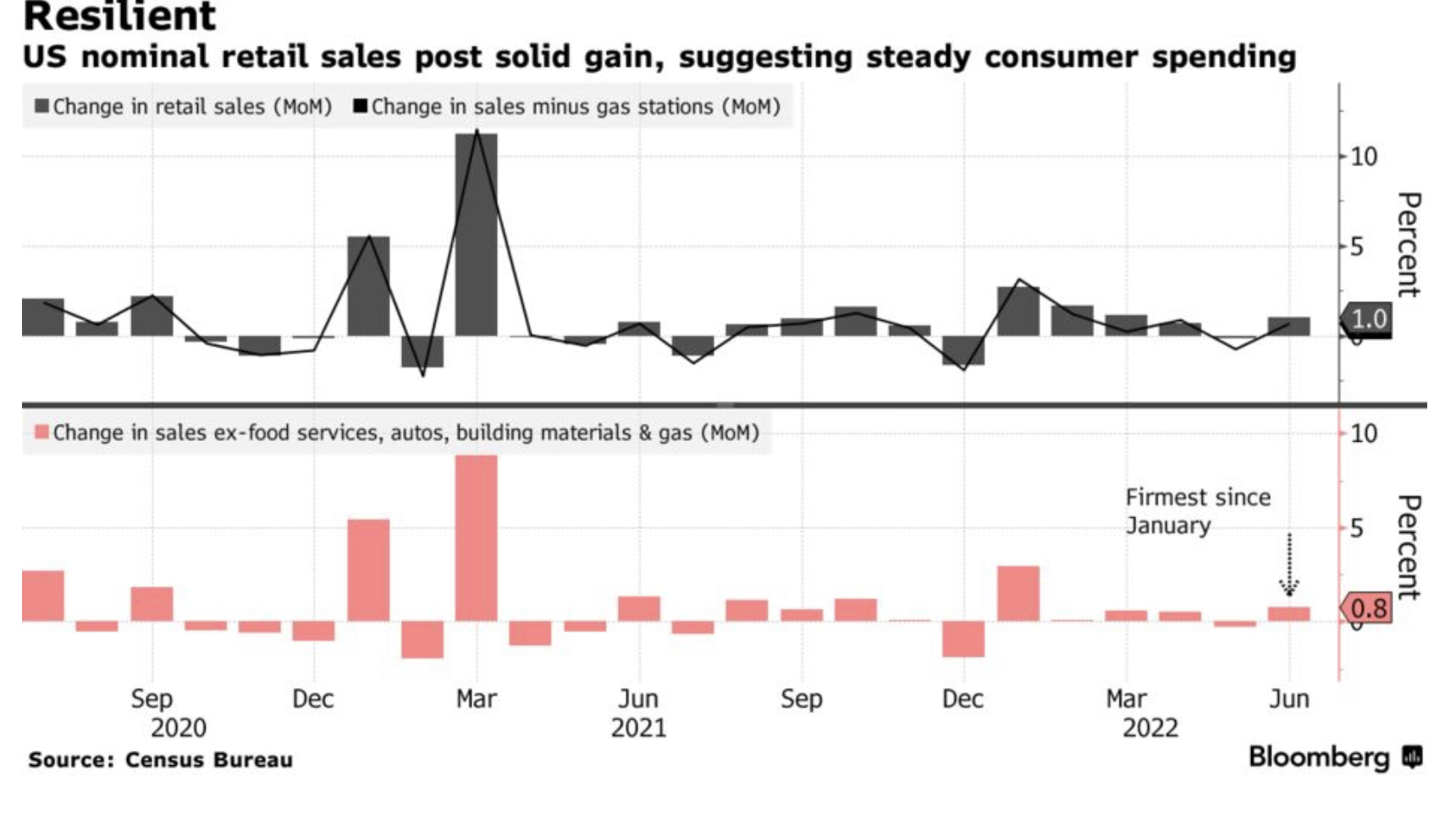

Consumer spending overall is up. Especially on items that aren’t necessities.

This makes sense because, duh, everything is more expensive.

But since inflation is being largely driven at the level of necessities, spending on non-essentials (the kind of spending consumers use a Visa card for) is still going up.

This makes sense in the next chart:

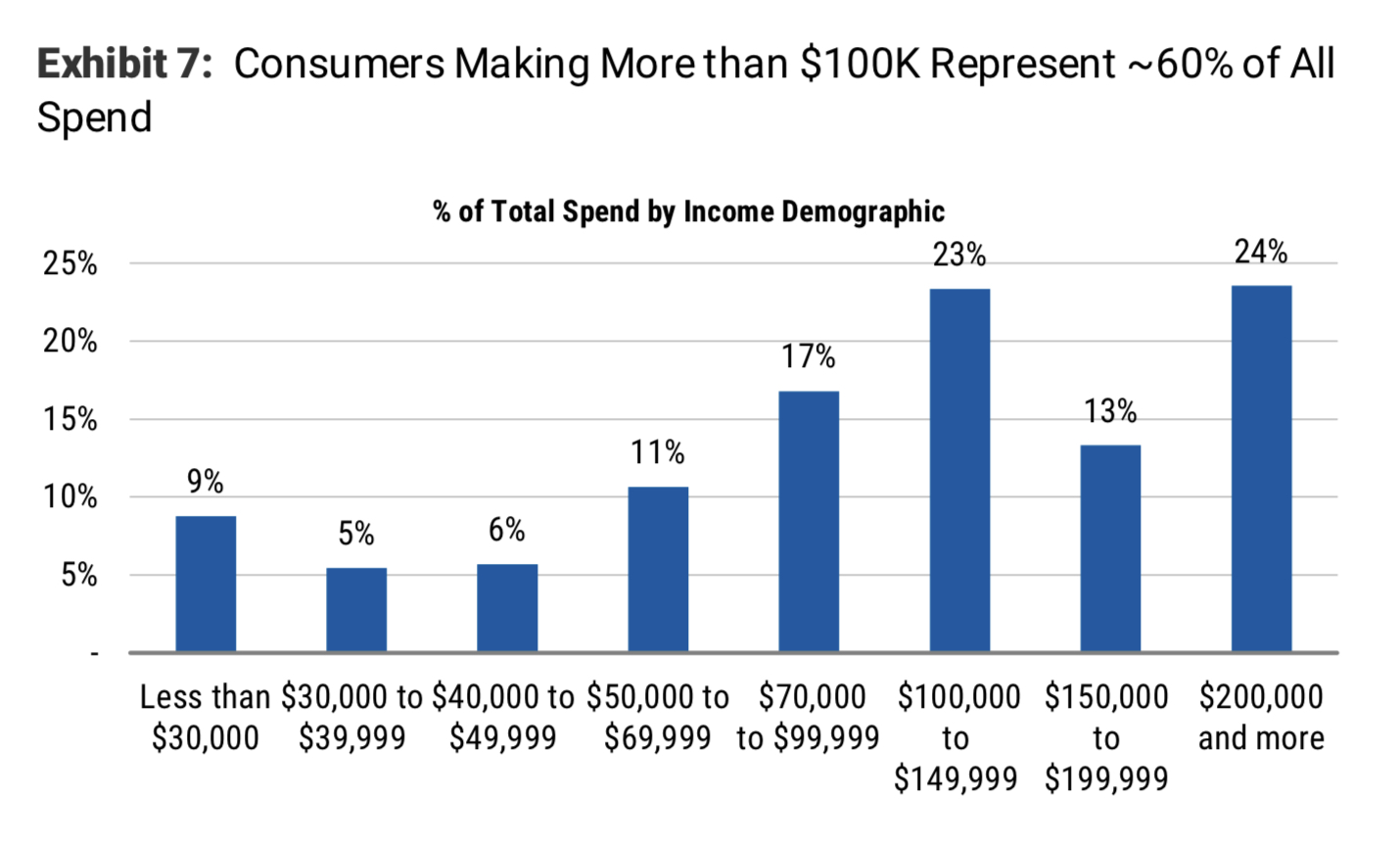

More than 60% of all consumer spending is done in households making more than $100k a year.

The more you make, the lower your burden is for necessities. A household making $50K a year spends 41% of their income on food, housing, energy, and shelter while a household making $200k or more on average only spends 23% of their income on those same categories.

So while every single consumer worldwide is feeling the effects of inflation, Visa’s customer base isn’t getting hit as badly as other cohorts. So, consumer spending can still increase throughout 2022 (even with the Fed working as hard as possible to try and put a stop to that).

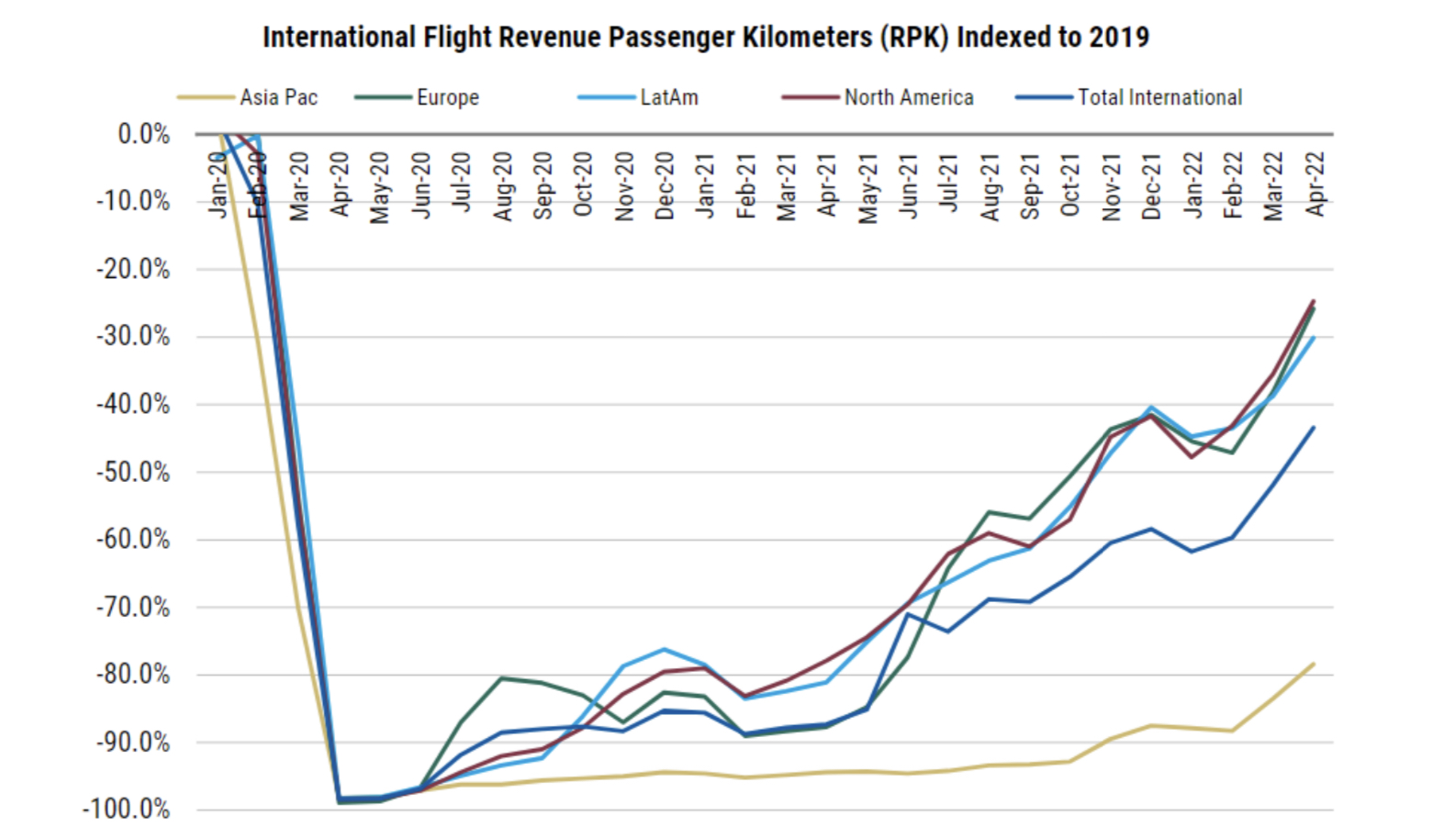

You can especially see this in travel. Travel is starting to kick off strong despite inflation:

The market is starting to price this in, with Visa up 3% in the week after the CPI report tanked a large section of the market.

So that’s cool, but what if Jerome Powell and crew have to push too hard on interest rates and stumble the US into a full-blown recession?

Visa Outperforms in Recessions:

That’s honestly where this analysis started. Our team is hunting for value plays that will grow even in a recessionary environment.

So we look to previous recessions and see who does comparatively well in their respective sectors.

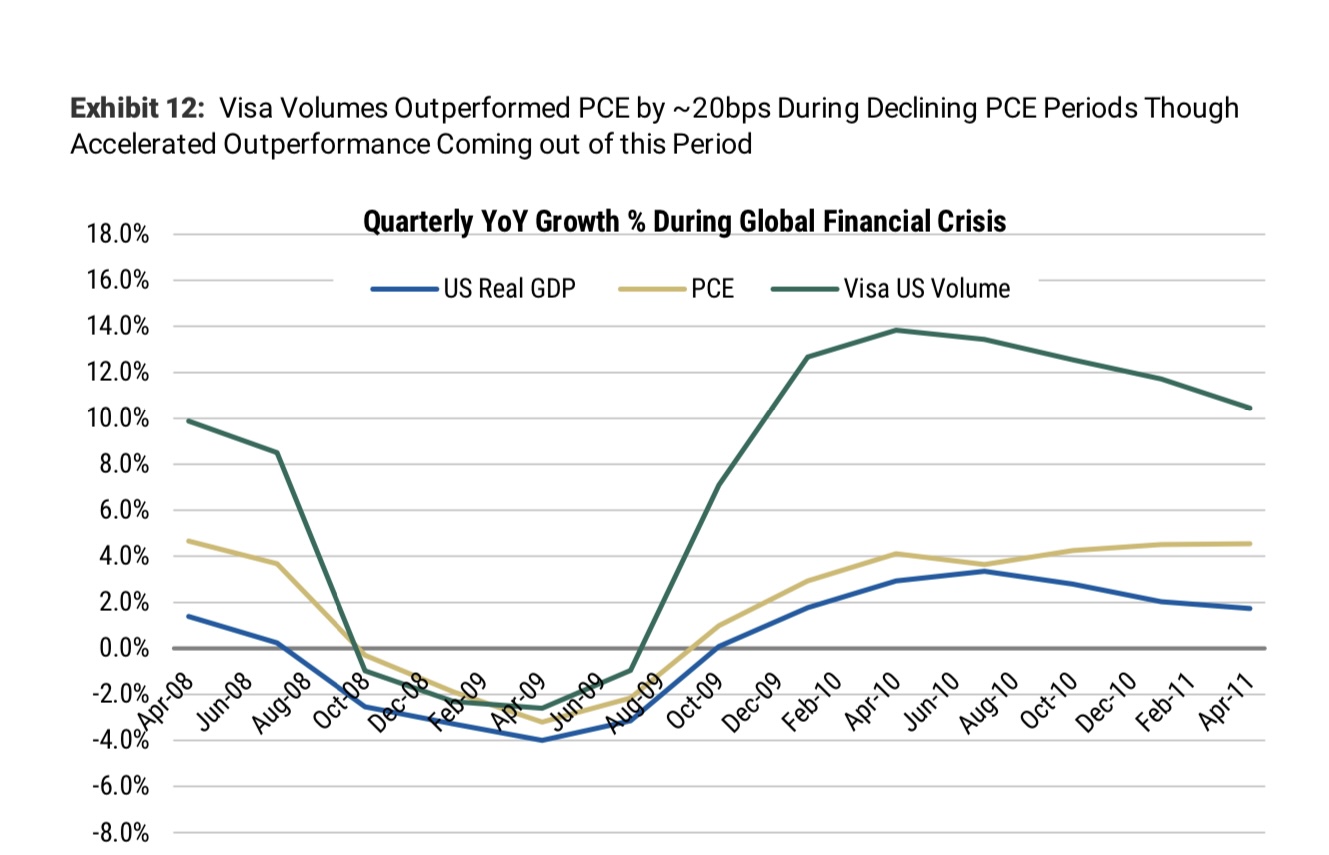

And Visa was a massive outperformer during the 2008-2009 collapse that kicked off the Great Recession.

Look carefully, Visa was just as low as the rest of the market during the actual year-long collapse from August 2008 to August 2009.

But Visa’s volume recovered quickly and even hit strong YoY growth targets well before the rest of the market started it’s recovery.

Visa gets paid on volume. All that means is Visa takes a fee for every transaction on it’s network.

So the moment consumer spending goes up in any way, Visa’s volume goes up. When Visa’s volume goes up, their revenue increases.

If the Fed pushes us (or has already pushed us) into a classic recession, then Visa still has the necessary strengths to recover quickly and even outperform while other members of the S&P 500 lag behind in a big way.

Visa Outlook:

And it’s not even the composition of this economic moment that gives Visa an advantage here.

Despite basically every other big industry getting disrupted in some way by tech,

Visa and it’s rival Mastercard have adapted brilliantly to the endless waves of new technology that make payments simpler, more digital, and more widespread.

Visa is in the process of making digital payments easier than ever while also expanding into various B2B verticals. So rather than resting on the strength of their core business, Visa is establishing strong footholds that will allow it to moderately expand its TAM in the next year.

All-in-all, while Visa’s growth isn’t the massive gains we grew accustomed to during this last tech bull-run, it’s definitely a strong candidate for portfolios that need more robust foundations in payments!

Price Target: $280 (35% upside)

Current Price: $207

Target Date: Q2 2023

Rating: Overweight

Risk/Reward: Medium-High / High

Ticker: V

Market Cap: $431B

Dividend Yield: 0.72%