With the market refusing to kick it's volatility habit, we're letting our pharma-guy post one more pick adjacent to the recent boom in healthcare and biotech.

Rather than going too heavy into pharma companies, let's discuss the primary supplier profiting from this latest surge in research and spending: Thermo Fisher Scientific (TMO)

If you've ever even been near a lab of any kind, chances are you've interacted with some form of TMO equipment. They're the premier provider and manufacturer of laboratory equipment and supplies worldwide. They've done brilliant work developing their brand and equipment to the point where organic growth is taking over, especially in emerging high-growth markets.

The main threat pushing TMO's stock price down in the last 6 months has been worries about the company being too reliant on revenue from COVID-19 testing.

However, despite a 12% reduction in revenue from COVID testing, TMO has managed to raise revenues year-over-year, signaling that they are moving their company in the right direction to ensure strong growth as the world moves into the next phase of managing and mitigating this pandemic.

There's so much to like about TMO, but the main principle is this:

When you're in any kind of gold rush. It's always a better bet to invest in the folks selling the shovels.

Let's get into it 👇

Thermo Fisher Scientific Overview :

Technically the principle elements of TMO have been around since the 1950s, but they became the industry-dominating colossus after a big merger in 2006. Thermo Fisher is the Amazon of laboratories everywhere.

That is, they sell equipment to labs as well as the reagents scientists need to run said equipment. It's only an exciting company if you were raised by laboratory-dwelling dweebs and like to geek out about mass-spectrometers, chromatography resin, and the next generation of gene-sequencing machines.

We've informed our pharma-analyst that our readers don't want to read 5 paragraphs on the cool new equipment TMO is developing, and instead have opted to remind you about one of the most important rules during a volatile period of the market:

Boring is Beautiful

The cool 'sexy' companies invariably have higher risks. And that's why we're sticking to "boring B2B plays" like Thermo Fisher during this ongoing volatility.

So, there are three main aspects driving Thermo Fisher's growth right now:

-

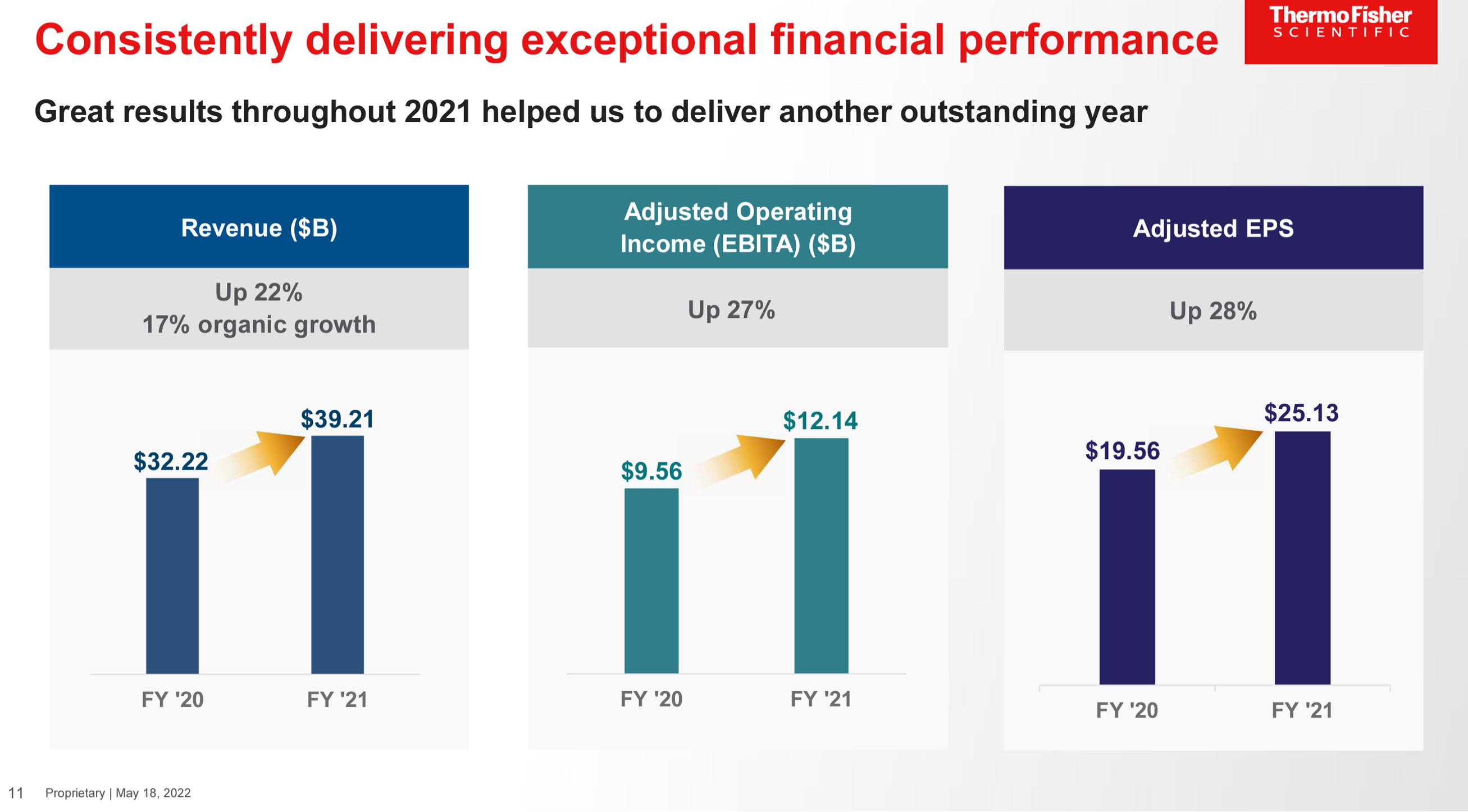

Expanding core revenue. TMO's life sciences revenue popped off over the last fiscal year, leading to 22% overall revenue growth. This is primarily coming from their Pharma and Biosciences revenue line, which is huge because it used to be that over 15% of their revenue came from COVID 19 testing alone. With revenue from testing down 12%, TMO still scored 22% revenue growth. This signals to us that this revenue growth is sustainable and not short-lived due to revenues associated with COVID testing.

-

Increased organic growth. 17% of that growth came organically from new and legacy customers. By being so dominant, TMO has managed to simply become the default provider for equipment and reagents worldwide. Cheap growth means higher margins, allowing TMO some flexibility even as the market becomes more volatile and competitive. What's even more, is that now metrics like margin, EBITDA, etc. are more center than ever as investors care about sustainable growth, rather than just growth at all costs. Therefore the fact that these metrics are improving, is now more valuable than ever for TMO.

-

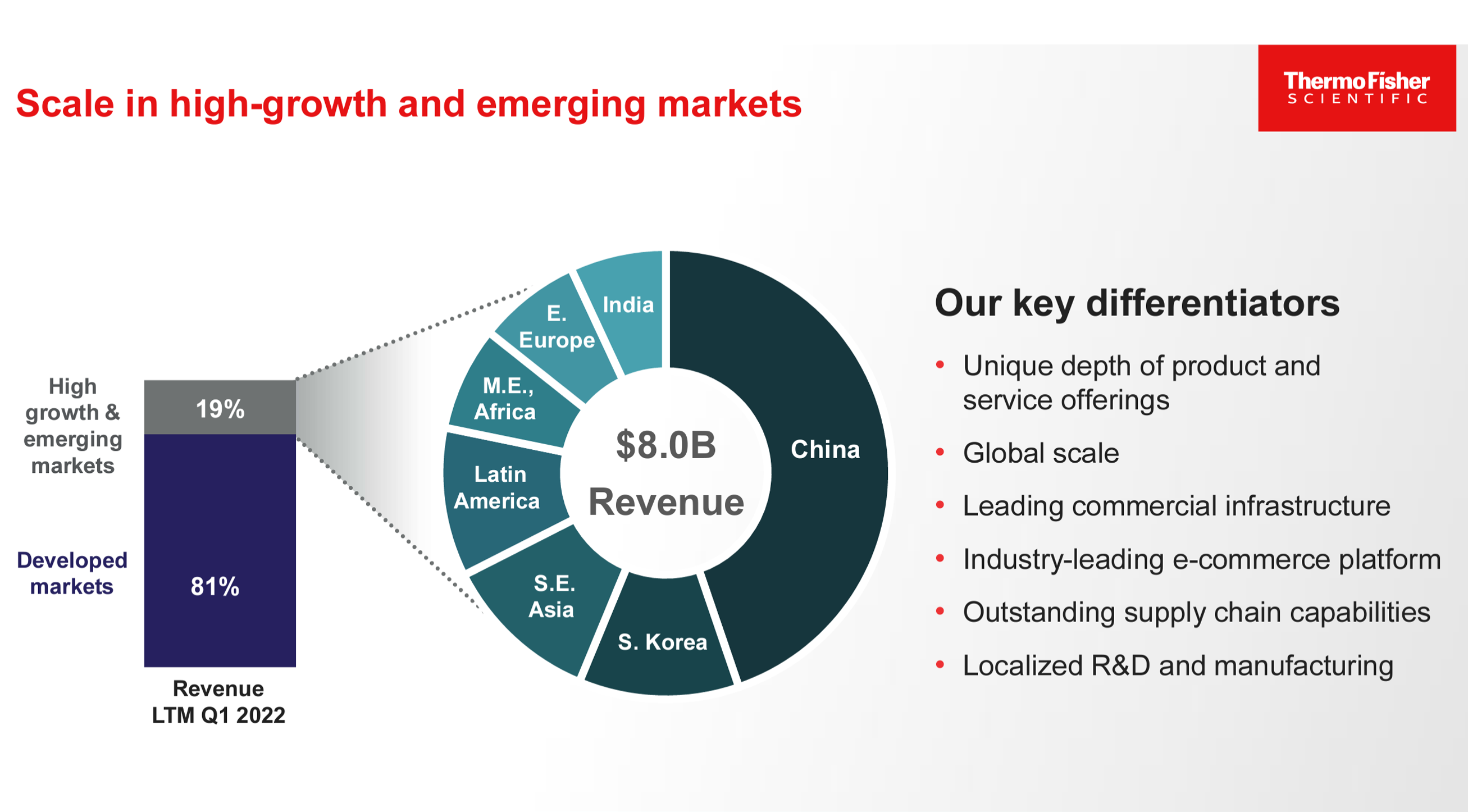

Penetration into high-growth markets. Globally there have been incredible advancements in healthcare and scientific infrastructure in the last 15 years that are really starting to come into fruition. TMO is emerging as a lead provider even in these emerging markets that will have high-growth potential for the next 5 years.

TMO Outlook:

The main growth areas for Thermo Fisher moving forward are going to be cell and gene therapy, along with regional growth effects.

Cell and gene therapies are VASTLY different areas of science that are advancing at a breakneck pace right now. TMO's big differentiator is making affordable versions of new equipment capable of doing analysis that labs rely on to develop and perform these two new(ish) areas of therapy. Gene therapy can vastly expand access to infertility treatment for the tens of millions of couples trying to start a family.

And that's just one of many examples. TMO is going to grow on the heels of a lot of new investments in biotech worldwide.

China is leading a lot of those investments, but the US is starting to catch back up after all the disruptions caused by the last two years of the pandemic. TMO has built a robust e-commerce operation and a dizzyingly complex series of upsell opportunities for clients across the spectrum.

Long story short, if you want to hedge your bets as you ride the high-risk investment boom that will hit biotech across this next volatile period--stick with providers like Thermo Fisher as their reagents sell no matter how well various biotech plays rise and fall.

We're really excited to see how they continue to grow into the future.

Price Target: $689 (21% upside)

Current Price: $570

Target Date: 9-12 Months

Rating: Overweight

Ticker: TMO

Market Cap: $223B

Dividend Yield: 0.21%