With the market still not ready to fully shift into bull territory, we're still hunting for longer-term defensive plays that can have great growth opportunities once we get fully past this inflationary environment.

For us, automation and green energy are two of the biggest bull-territory trends we're examining.

So, that makes this strategy pretty exciting, as Emerson Electric ($EMR) is pivoting in a way that will allow them to capture upside from both the automation and green energy industries.

Emerson is an old-school electric play (think GE but like, in Missouri) that has been adapting pretty well to this rapidly shifting energy landscape.

And now the company is poised to be a major player in the green hydrogen industry that we're so bullish on.

Furthermore, Emerson is poised to utilize their software expertise to be an automation powerhouse for the next few years.

And even more importantly, EMR is looking to combine those two strengths to drive even more value.

The stock is a little undervalued while the market is afraid that EMR is about to pay too much for a proposed acquisition of National Instruments.

However, management at Emerson has strongly indicated that they will walk away from the acquisition before they are forced to overpay. Basically, EMR only gets hurt in the long term here if they are duped into paying too much.

But since we really don't see this management team making a move that boneheaded, we see this as a sold inflection point to initiate coverage on EMR while the dust settles.

While there is a little short-term risk with the threat of overpaying for that acquisition, long term there is a LOT to like at Emerson.

Spring is in full swing for any industrial play that can make a run at Biden's IRA. There are a lot of great trends converging here, so let's dive into the details 👇

Emerson Overview:

Emerson Electric is your classic 20th-century device conglomerate. Again, think GE, but based in Missouri.

In the past, Emerson was known for everything from power plant controllers to garbage disposals.

But in the past 5 years, Emerson has refined itself into way more specific verticals:

Basically, if you have a complex industrial system, Emerson's devices and software can help you streamline and control that system.

There are thousands of small products all within Emerson's major segments, but their two major focuses will be in energy and automation (more on that later).

Emerson has been leveraging their portfolio company AspenTech to optimize all of their intelligent devices verticals to make them as profitable as possible.

That's been going great and allowing EMR to post truly ludicrous EBITDA on these expensive verticals.

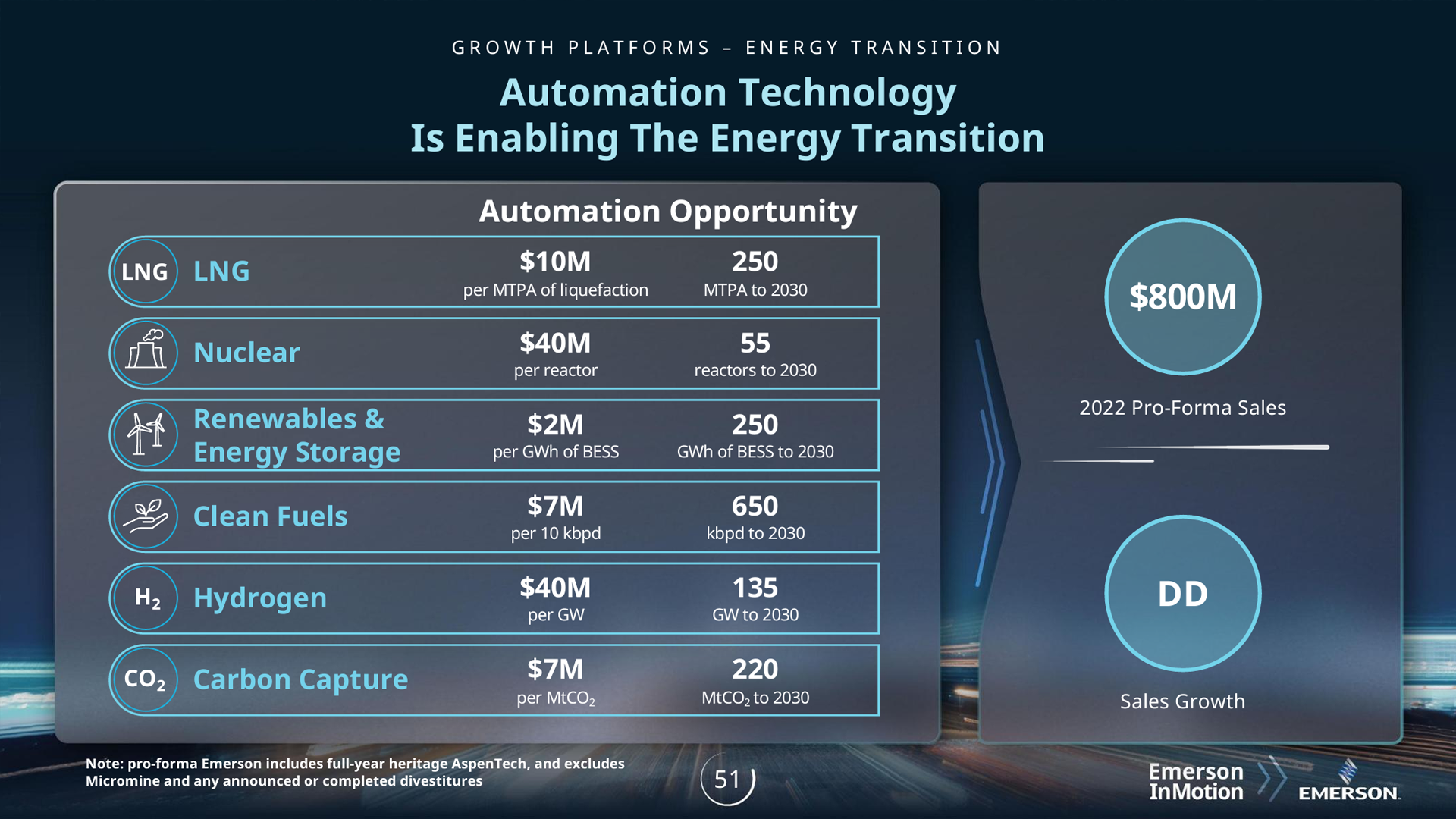

We can break these control systems down in dozens of different ways, but Emerson management sees the company more poised to grow by focusing on clients building towards a worldwide energy transition.

Switching from coal-fired power plants to greener energy is expensive in the short term, and Emerson's control and automation products allow industrial clients to optimize costs in such a way that it becomes profitable way sooner. That's one of their biggest growth trajectories.

They capture upside by upgrading older powerplants and helping build more optimal ones.

We like this play because EMR can save clients a lot of money across a LOT of different types of power plants.

In addition to the green energy classics, their products work for Nuclear, Hydrogen, and even liquid natural gas for areas that simply can't quite swing the expense of full renewable reliance.

All of this combines with EMR's new focus on helping the production of green hydrogen as they move towards the 2030s.

Where Green Energy and Automation Meet:

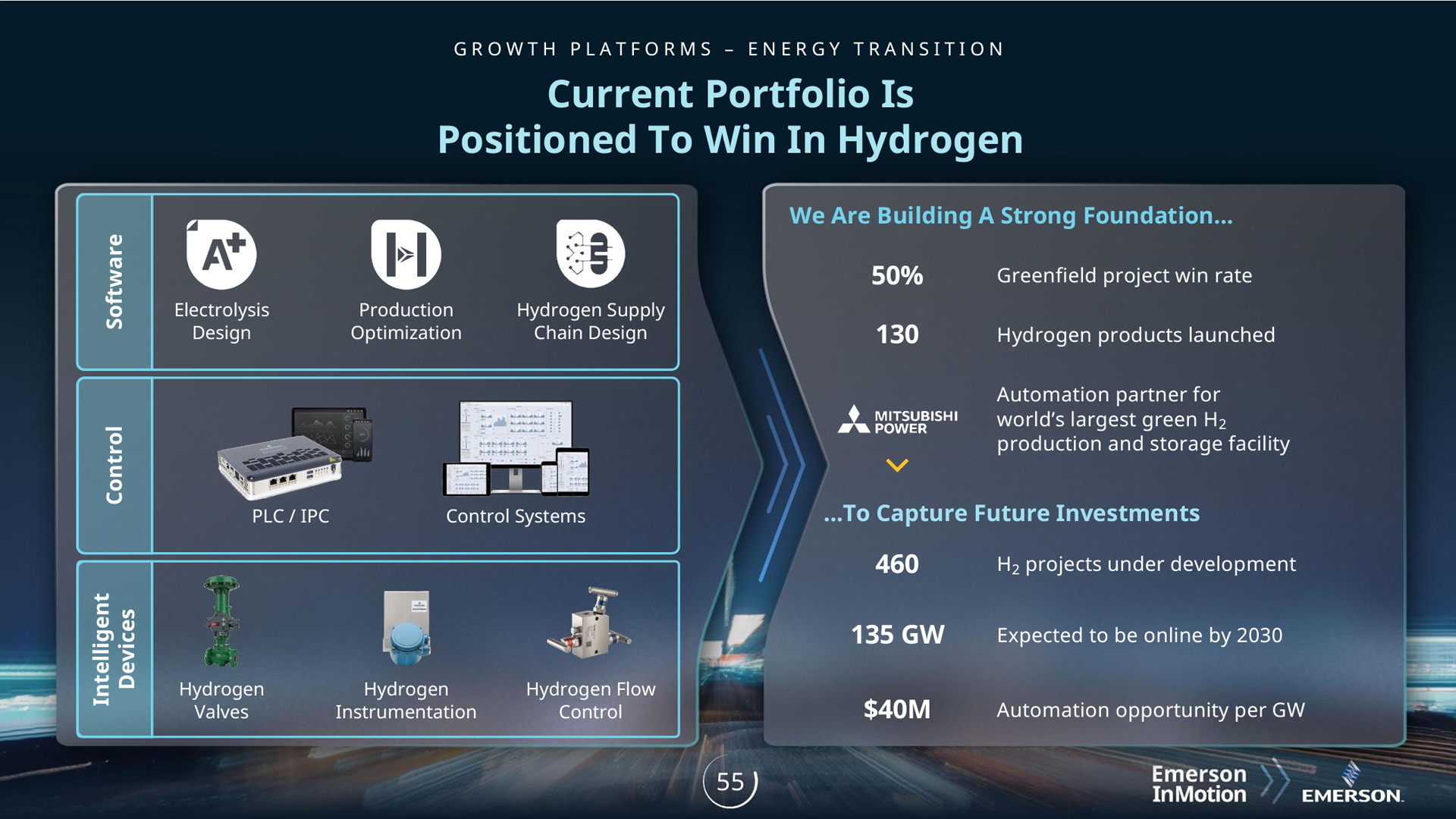

For us, Emerson's biggest move in the next 5 years will be in the green hydrogen space.

They aren't directly competing with hydrogen firms like Plug Power, they're simply building and selling the devices and software necessary to produce and automate the production of green hydrogen.

Currently, EMR is working with Mitsubishi Power on the world's largest green hydrogen production facility.

And that's where we get excited because EMR is simply selling the tools necessary to scale green hydrogen production.

Once again, when you're confident about an industry, make sure you derisk your investments a little by adding companies that get paid first in a supply chain.

The IRA is flooding the market with investment opportunities for green hydrogen.

And instead of focusing on making H2 themselves, Emerson is the company that will get paid upfront to build the facilities, software, and instrumentation necessary to produce the most H2 at the smallest cost.

Once again: in any gold rush it's important to seek out those folks selling the shovels, not just the gold itself.

Emerson is going to be a solid winner in the renewables space pretty much regardless of who actually wins the H2 production race.

Additionally, every client EMR adds on the software side gives them critical data to optimize their automation products.

This is huge with the ongoing restoring trend we're seeing in US manufacturing and industry.

Automation in the green energy space will be a double-whammy for EMR as they can save their customers money while those customers have their operations smoothed out by significant tax breaks from the Inflation Reduction Act.

Automation in the green energy space will be a double-whammy for EMR as they can save their customers money while those customers have their operations smoothed out by significant tax breaks from the Inflation Reduction Act.

All of this puts EMR in a solid position to capture tremendous upside while they help build a reduced-carbon future.

Emerson Outlook:

But again, EMR is a little undervalued in the short term as they sort out this potential acquisition of National Instruments. NATI can bring a lot of potential upside to EMR, they simply need to ensure that they don't get duped into overpaying.

There are two positive scenarios here:

-

Either EMR pays ~$55/ share in NATI and gets a lot of long-term upside from the synergies they can produce or

-

They bail on the acquisition after it becomes too expensive and their stock instantly returns to the levels we saw late last year.

The uncertainty is the only real reason EMR is being undervalued right now.

All in all, every single one of Emerson's verticals is growing well and the whole company is poised to be a margins powerhouse as they continue to improve the software side of things.

Their processes are complex and hard to compete with. The next 5 years are going to be a wild ride for the company and we can't wait to see what they do from here.

Price Target: $95 (19% upside)

Current Price: $80

Risk/Reward: Medium-high/ High

Rating: Overweight