Flagship Pod 90: Earnings Season in an Uncertain World

Every Friday we host a live 1 on 1 discussion at 12pm EST.

This gives you the best opportunity to ask us any questions you have on the markets, the economy, crypto, and more!

If you'd like to listen live and ask us questions throughout the next live session, just join the weekly Friday afternoon session at 12:00pm EST.

-

If you want to check out past episodes, we post them on Apple Podcasts: Click here

-

We're also on Spotify: Click here!

Now let's get into what we reviewed.

Here are the 4 key things we went over:

-

The key fallout from the conflict between Israel and Hamas

-

What has been happening in the bond market

-

Where earnings season has been surprising so far

-

What we're watching this week in earnings season

And if you're too busy to listen to the entire recording, below we included a compact summary of what went down.

To get all the juicy details, just listen to the entire recording. And now, onto the summary👇

Overview:

It's a tough week to unpack the market as the world holds its collective breath after the attacks against Israel that were carried out by Hamas over a week ago. With evacuation orders given by the IDF and troops massing at the border, the world is holding its collective breath hoping for a more peaceful solution than currently seems possible.

In moments like this, it is really difficult being a podcast that talks about the market, because we have to boil down real lives being lost and real terror being experienced by people in the region into how this affects price action in markets on the other side of the world.

But, it's important to stick with our perspective and give you the information you come here for, so today we'll talk about the flight to safety we're seeing in the market and how that's simultaneously driving bond yields down and the price of gold up. We'll look into oil prices and how the next few weeks can cause all sorts of mayhem with global oil supply.

Meanwhile, we'll bring things back to Wall Street as well given that earnings season is off to a great start. There are a few issues in some numbers, but otherwise, we're really encouraged by the positive reports we've gotten so far.

It's a messy time in the market, and things may only get messier. But we'll try to cut through the noise and bring you just the consolidated information you actually need to stay ahead. Let's get into it. 👇

Global Markets React to Israeli Conflict:

At this moment, the world is expecting some level of a ground invasion of the Gaza Strip by the IDF in an effort to recover Israeli hostages and crush Hamas. While the IDF's incursions into Gaza have been limited to airstrikes and raids, a wider invasion could have drastic worldwide consequences.

Iran has threatened action pending on how Israel conducts operations in Gaza, while border skirmishes in the north between Israel and Hezbollah have been intensifying.

Meanwhile, the U.S. is considering sending a second aircraft carrier group to the Eastern Mediterranean to try and stabilize the situation.

While that is a drastically sparse overview of what is happening in the Middle East right now, we're only pointing out the major nodes of the conflict to illustrate the fact that this conflict can widen in scope pretty quickly, and that's what investors are afraid of.

After oil prices crashed earlier in October on reports that U.S. oil and gas demand had flatlined, oil prices and futures shot up this week on fears that a wider conflict could hamper crude supply. Meanwhile, the U.S. turned up the heat even higher by tightening up the enforcement of price caps on Russian oil, adding to the fear in the market.

Gold and silver prices also rose as investors sought safe harbor in commodities. The main thing that suffered during all this panic buying was U.S. Treasuries. Paradoxically, the more people buy bonds, the lower bond yields go. Therefore, we actually saw stocks rise last week, with every major index ending positive on the week (with the S&P and NASDAQ barely anything above flat).

Basically, the only certainty in the market for the next few weeks is going to be wild, volatile price action like this as the conflict evolves. It's going to take a long time to filter the signal from the noise, which will make earnings season pretty complicated to parse.

But let's try anyway.

Bank Earnings Show Strength:

A big part of the selloff we saw in September was the market's assumption that earnings were finally going to start compressing under the weight of higher interest rates.

So, when bank earnings were reported last Friday, we were delighted to see, for the most part, a lot of strength in the financial sector.

The biggest outlier here is JP Morgan, whose revenue and profit have surged to record levels. JP Morgan stock has surged nearly 30% in the past 12 months and showing no sign of slowing down. In moments like this where there is tremendous economic pressure on the market, the chief danger becomes consolidation as capital flees weaker players and flows to only the strongest.

JP Morgan is looking really unstoppable right now while some regional banks are starting to waver a little under the pressure. Sure, names like PNC managed to maintain earnings growth, but some are starting to miss revenue targets. If this persists, JP Morgan and other strong banks might be able to gobble up even more regional names. Too much power in too few players can lead to inefficiencies of their own, but these issues play out over the course of years, so it's not something that's going to directly impact the market in the near future.

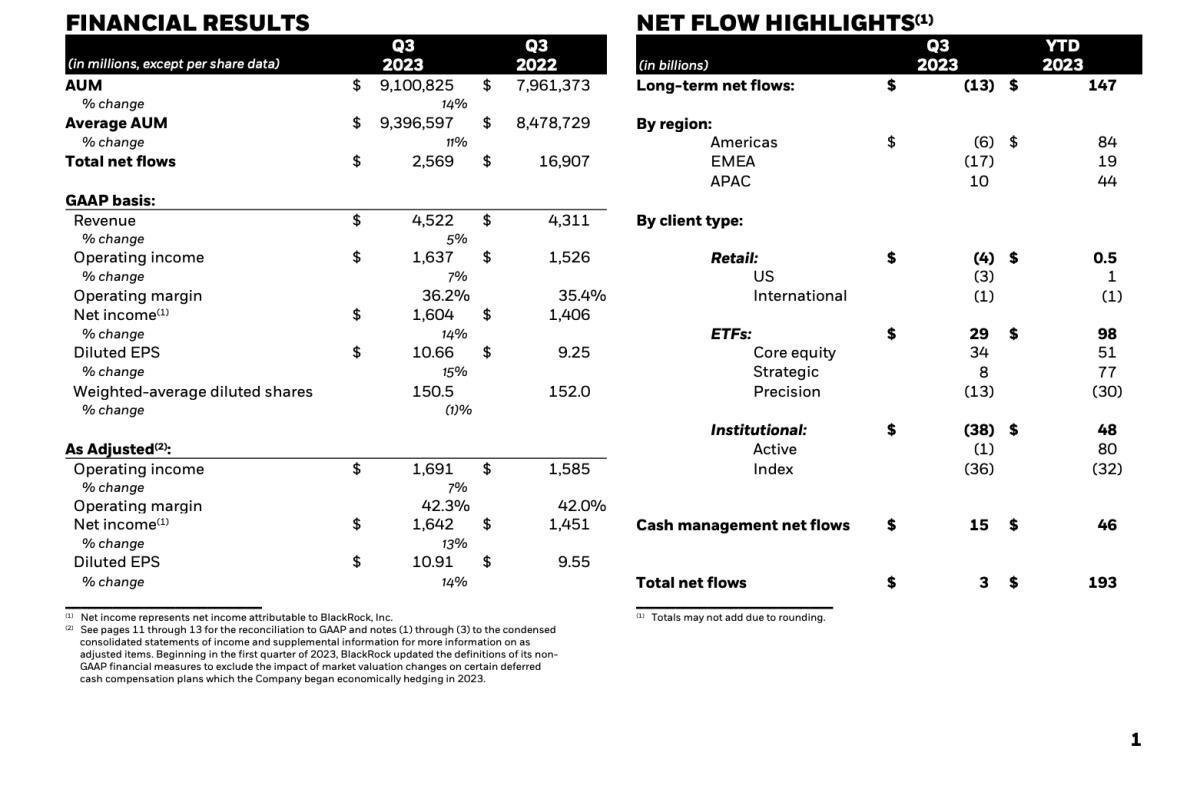

Bank earnings are also showing us exactly how big-money investors are reacting to this environment. Blackrock is experiencing a moment where outflows are heavily outweighing inflows, but when you look at their actual reporting, you see this is more of an industry-wide issue:

Yes, right now Blackrock is experiencing some heavy outflows, but most of those are coming from institutional clients bailing entirely on index strategies. The biggest investors are all too aware of the fact that we have to be a lot more strategic with our capital now that the market is putting a lot of pressure on individual companies.

As we stay in this high-interest environment for longer, more specific and well-managed strategies are going to win out over general index players.

But the key highlight here is that, at their core, financial institutions are much stronger than we previously realized, so we're encouraged by the health of the overall market for now.

Wrapping This Up:

It's going to be a complicated week in the market with major players like Tesla and TSMC reporting earnings as the next FOMC meeting hits. While it's really unlikely that JPowell & friends will raise rates again, there's still a good amount of fear out there that he will.

For Tesla, everything hinges on their margin-per-vehicle. Tesla has been getting sold off pretty consistently as investors react to the depressed production and shipment numbers that came out of factory shutdowns over the summer. Tesla has presented some compelling upgrades to their factories as a reason for these shutdowns, but will they be enough to help margins keep up with recent price cuts for Tesla vehicles?

There are efficiencies like that playing out all across the market. Welcome to another wild week as we try to stay ahead of an avalanche of economic news.

We'll keep you posted as the market develops.