Price Target: $910 (18% upside)

Current Price: $770

Target Date: Q1 2025

Rating: Overweight

Even though we've been covering Eli Lilly ($LLY) for over 4 years and have been bullish on the GLP-1 revolution for far longer than most other shops, we are still in awe of their progress over the last year.

We'll be straight with you -- our analyst team is borderline baffled by the fact that we're writing a stock position that puts a pharma play like LLY within sniffing distance of a $1 trillion market cap.

Given all the small factors that have to go right to push LLY to that level, especially in the context of how competitive the GLP-1 space is becoming, we're still more comfortable keeping our price target at a "conservative level". We'd rather check in with the stock quarterly than overextend ourselves after such a brilliant run.

While Eli Lilly perfectly positioned themselves to be king of this new weight loss market, an astonishing number of things have gone LLY's way in the last 3 years to make their position as unassailable as it is.

Given that trial data can turn on an absolute dime (just ask the bagholders at Pfizer), we're going to maintain quarterly updates of our position in LLY if they keep ripping through our price targets. We're also going to give you a list of things that can slam this stock downward in the next year.

That being said, LLY isn't nearly as overbought as stocks in the AI space are.

Eli Lilly has achieved some astonishing growth since our last update and is only poised to compound that growth this year as their Zepbound brand ramps up alongside new treatments.

Eli Lilly managed to crash through a fairly aggressive price target we set 4 months ago without one of the major catalysts we've been waiting for. A multivariate set of approvals and manufacturing expansions are on the docket for this year and we are in awe that LLY still has so much room to run after our initial position rose over 400%.

So, despite all the progress let's try to throw some cold water on all these narratives and take a sober, even-handed look at how Eli Lilly can make an honest run at a $1 trillion valuation.

At this scale and with this many advantages, we believe LLY can really pull this off. But heights this high aren't without risk.

So, let's explore LLY's newfound dominance and what's coming next.

Eli Lilly Update:

There's only one real story at Eli Lilly and that's Mounjaro and Zepbound.

This time last year, we were ecstatic when Mounjaro achieved just shy of half a billion in sales. In Q3 of last year, we were blown away that Mounjaro managed to triple its revenue in 9 months to $1.44 billion (along with other new products at LLY). And in Q4 of 2023, Mounjaro and its weight loss brand Zepbound, combined with other new products at Eli Lilly to hit $2.49 billion in sales.

That's a vertical growth profile the likes of which is basically unfathomable in the pharma business.

Eli Lilly's guidance for 2024 is enough to push toward our price target on its own. But at this level, we need to examine how they can pull off these lofty goals.

With Mounjaro's underlying compound approved for weight loss, doctors have multiple pathways to lock in insurance approval while 3rd-party services have a much easier time generating prescriptions for the injection.

The floodgates truly are open here:

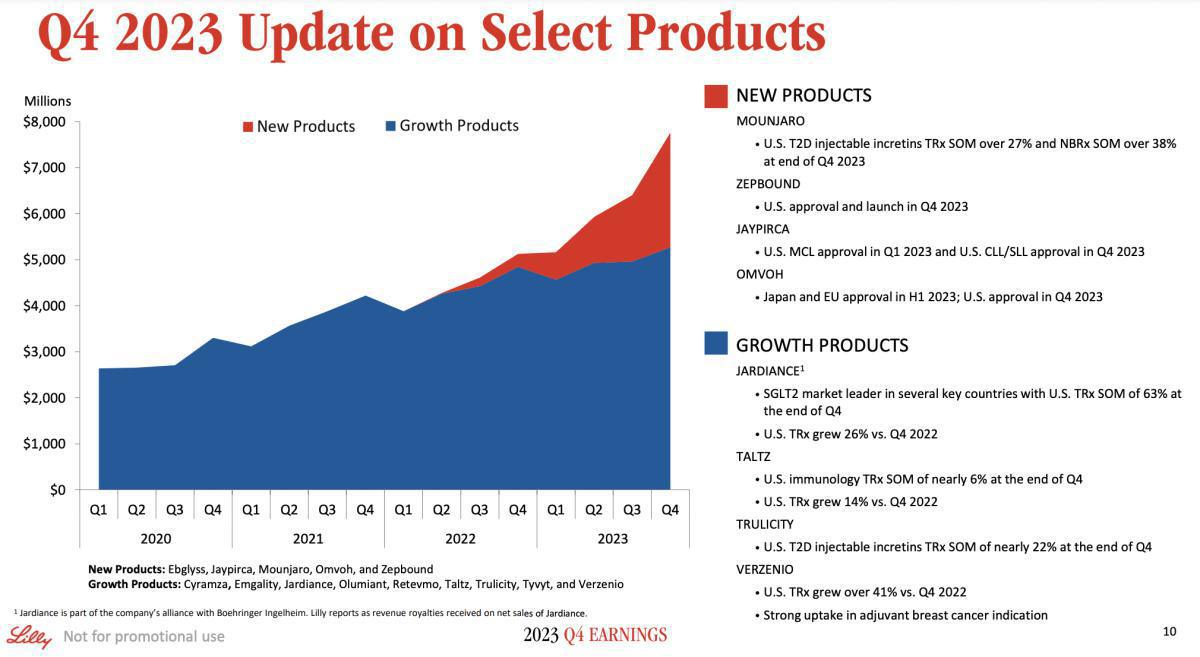

While LLY groups a bunch of different treatments into that red 'new products' category, the real stars here are Mounjaro and Zepbound.

As we said before, new product revenue grew by over $2 billion in the last year. $1 billion of that growth happened in the last quarter alone.

And, LLY's foundational 'growth products' category isn't slouching either. Verzenio in particular surged 41% in the last year.

This is the sweet spot any company wants to be in. New products are driving outsized revenue gains without hurting the growth of core products.

With that said, Mounjaro and Zepbound are hitting such a high level of adoption that for the first time since we initiated coverage, Eli Lilly's new products category outperformed their growth products foundation.

Sometime in the next 18 months, the majority of Eli Lilly's revenue will come from GLP-1 treatments like Mounjaro.

Compounding Growth Drivers:

Here's something that gets covered up by all this revenue growth: Mounjaro is growing really well right now thanks to an expansion of their diabetes market.

While weight loss prescriptions are skyrocketing, there is a solid case to be made that The Street is not fully pricing in the diabetes opportunity here.

Even though Eli Lilly's potential growth might be undercounted, the market can still overreact to any perceived headwinds given how much bull sentiment is behind this stock.

So, we now need to look into Eli Lilly's growth profile in 2024 and make sure they can sustain this trajectory enough to hit our price target.

Sure, Monjaro and Zepbound are the kings of the GLP-1 market, but can they stay there?

The first major hurdle that could slow Eli Lilly here is manufacturing.

Sure, demand is super high, but autoinjectors are complicated, and expanding manufacturing capacity can eat into margins. Eli Lilly appears to be boosting their manufacturing capacity at a robust enough clip to keep up with demand. With Novo Nordisk straight-up buying the supplier Catalent, LLY needs to respond by further boosting their capacity at their North Carolina plant.

Right now, LLY is projecting solid growth of auto-injector supply as they build out capacity at that facility, so we're encouraged that LLY can hit ever-higher production demand without hurting profits.

The worst case here is that LLY has to sink some expanded cash flow into making sure this plant hits their goals. But LLY can still make it to our price target if that transpires.

With that said Eli Lilly is also boosting their European capacity.

While Mounjaro and Zepbound aren't going to become major forces in Europe anytime soon, Eli Lilly is picking the right moment to push further into Europe given the current outlook for a weakening dollar and strengthening Euro.

So now, Eli Lilly's major headwinds will be competitors in the space.

Sure, Eli Lilly is on top right now, but when an area suddenly looks like it will be a several-hundred-billion dollar revenue opportunity, investment is going to pour into that space to try and grab some upside.

We're going to go through some of these competitive catalysts one by one, but here's the headline:

Eli Lilly structured their development of GLP-1 treatments brilliantly. They have a diverse range of treatments and every major competitor to their dominance has suffered some kind of setback.

But let's double-click into the major catalysts here:

-

Mounjaro continues to show broader efficacy. LLY is leading the GLP-1 space right now after a blockbuster trial printed, demonstrating Mounjaro is effective for treating liver disease. Turns out, a wide spectrum of diseases might be the result of our relationship with carbohydrates. Eli Lilly was incredibly proactive in how they set up trials to get Mounjaro approved for a lot of different disorders. Three more treatments are nearing the end of phase III trials. These will show Mounjaro's efficacy for treating Obstructive Sleep Apnea, certain kinds of heart failure, and severe complications that result from obesity. We've harped on this before, but getting FDA approval for a wide range of diseases helps Mounjaro get prescribed more and more.

-

Eli Lilly appears to completely own the oral GLP-1 market. More trial data for LLY's Orforglipron is really encouraging ahead of a 2026 approval. With Pfizer's oral GLP-1 getting dropped due to liver issues, Orforglipron is set to really crush the oral GLP-1 market. Novo Nordisk's oral formulation of Ozempic will hit the market before Orforglipron, but LLY's treatment is a lot easier to take and will beat out Novo Nordisk provided that phase III data doesn't blow up the treatment the way Pfizer's was.

-

Mounjaro's successor is already showing a lot more promise. Viking Therapeutics recently made waves as early-stage trials of their GLP-1 treatment achieved better weight loss results than Mounjaro in a shorter time. While that could be just related to small sample sizes, Eli Lilly's Mounjaro successor Reartritutide is slightly ahead of Viking's treatment and looks to be just as effective. So, the moment a firm could actually threaten Eli Lilly, they have a response pretty much locked in.

All of these are going to drive Eli Lilly's stock throughout the next year as the GLP-1 market develops and broadens.

All these small details moving in Eli Lilly's favor are huge compounders for the stock as LLY drives toward a $1 trillion market cap.

Eli Lilly Outlook:

And all of this upside is locked in before Eli Lilly is slated to receive approval for their blockbuster Alzheimer's treatment later this month. LLY is about to compound their gains in this space by taking on other chronic treatments.

We're also eager to get results for a new breast cancer treatment LLY has in its pipeline. Eli Lilly is at a historic moment where they have brilliantly designed a treatment rollout and gotten profoundly lucky that their formulations have been so incredibly effective.

Eli Lilly has been an incredible ride so far, but factors are in place to make it so that their $1 trillion market cap is only the start of their growth journey.

Price Target: $910 (18% upside)

Current Price: $770

Target Date: Q1 2025

Stock: Eli Lilly ($LLY)

Rating: Overweight

Risk/Reward: Medium / Medium High