Welcome back to this month's edition of the Flagship Dividend Portfolio!

As we've told you for over two years now, if you have been following along with the Moby Flagship Quantitative Dividend Portfolio, you should have continued to outperform the market while receiving over a 4% annual dividend.

And in this update, this message hasn't changed.

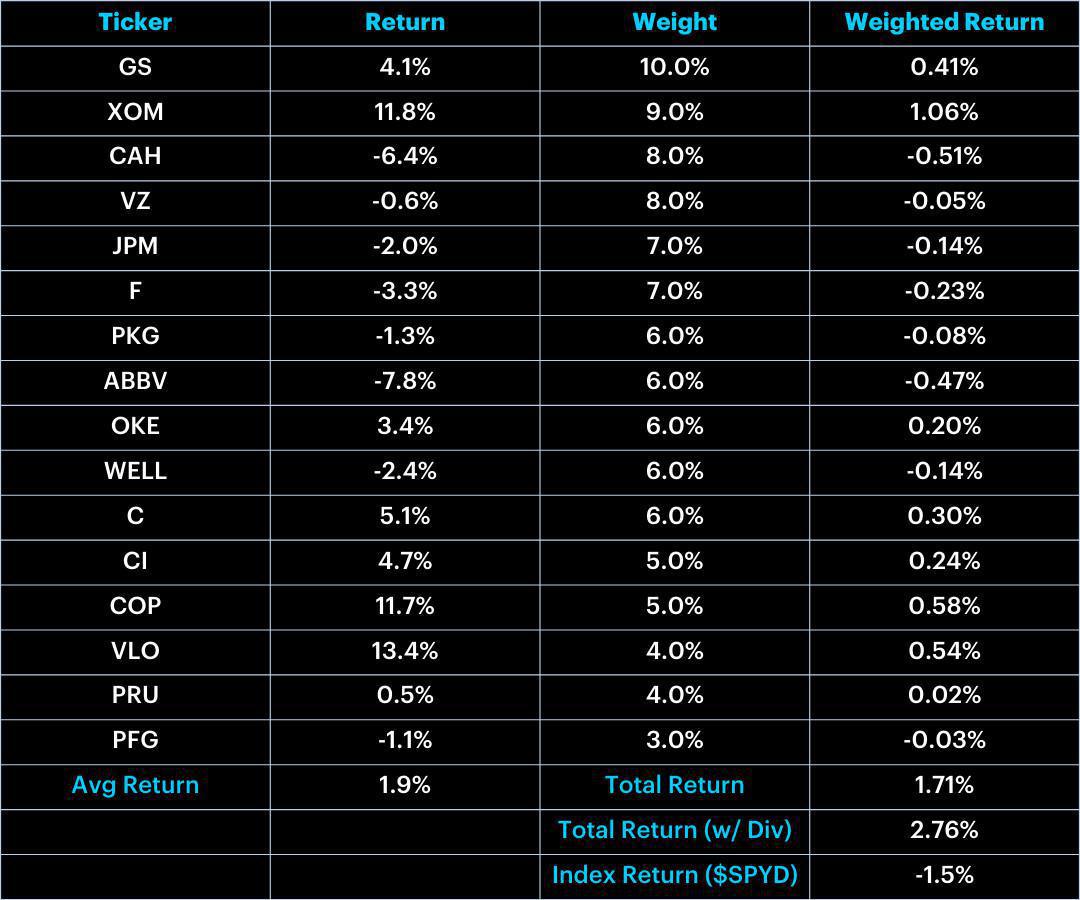

That's because we're proud to announce that we returned 2.8% since our last rebalance period while the index was down 1.5%!

There are many reasons this happened (more on this below), but our security & sector selection helped lead to our outperformance.

Therefore, since the goal of this portfolio is to beat the index — our goal was achieved. But that's why we have several unique strategies — so you can choose which portfolio fits your thematic goals.

While we do offer several different portfolios, the primary objective remains consistent: to generate stable and modest returns over the long term, supplemented by robust passive income through dividends.

Now, let's delve deeper into the performance breakdown of each stock within the portfolio, along with the latest trades. 👇

Performance:

If you've been following along, chances are you aren't too upset! In any case, let's dive into what led to the outperformance during this rebalance period.

First off, just take a look at the chart above. See any patterns? At a quick glance, we see that our energy stocks did well, while our healthcare investments lagged.

While this makes sense, given oil prices have climbed over the last re-balance period -- it bodes the question of why this is happening in the first place.

While we're dumbing down our answer quite a bit (for the sake of length), aside from inflation being higher than anticipated, increases in prices were likely due to concerns over supplies and geopolitical risks -- including wars in Ukraine and the Middle East.

While some of the tension has cooled in recent days, thus leading to prices decreasing, we anticipate this will ebb and flow for some time.

However oil prices aside, it's also notable because during the last re-balance period, it was the complete opposite as our energy names lagged the broader portfolio.

And this is a key part of the reason we've included them there in the first place. While energy names often pay healthy dividends, they also serve as diversifiers, giving us non-correleated assets to the S&P that have historically risen in value over time.

Furthermore, with inflation showing "no signs of slowing down" energy names often feel the tailwinds first -- being at the center of the supply chain.

But trends will reverse at some point. Inflation has to slow down and oil prices will be subject to volatility.

So what's the takeaway? While we outperformed and are pleased with the results, our true goal for this portfolio is to beat the index over the long run, not just a monthly period.

Therefore, while we're happy, it only tells half the story here. A win is a win, but the true wins are long-term outperformance. Long story short, it's a step in the right direction but the fight isn't over yet!

Now let's get into this period's changes👇

Model Changes:

-

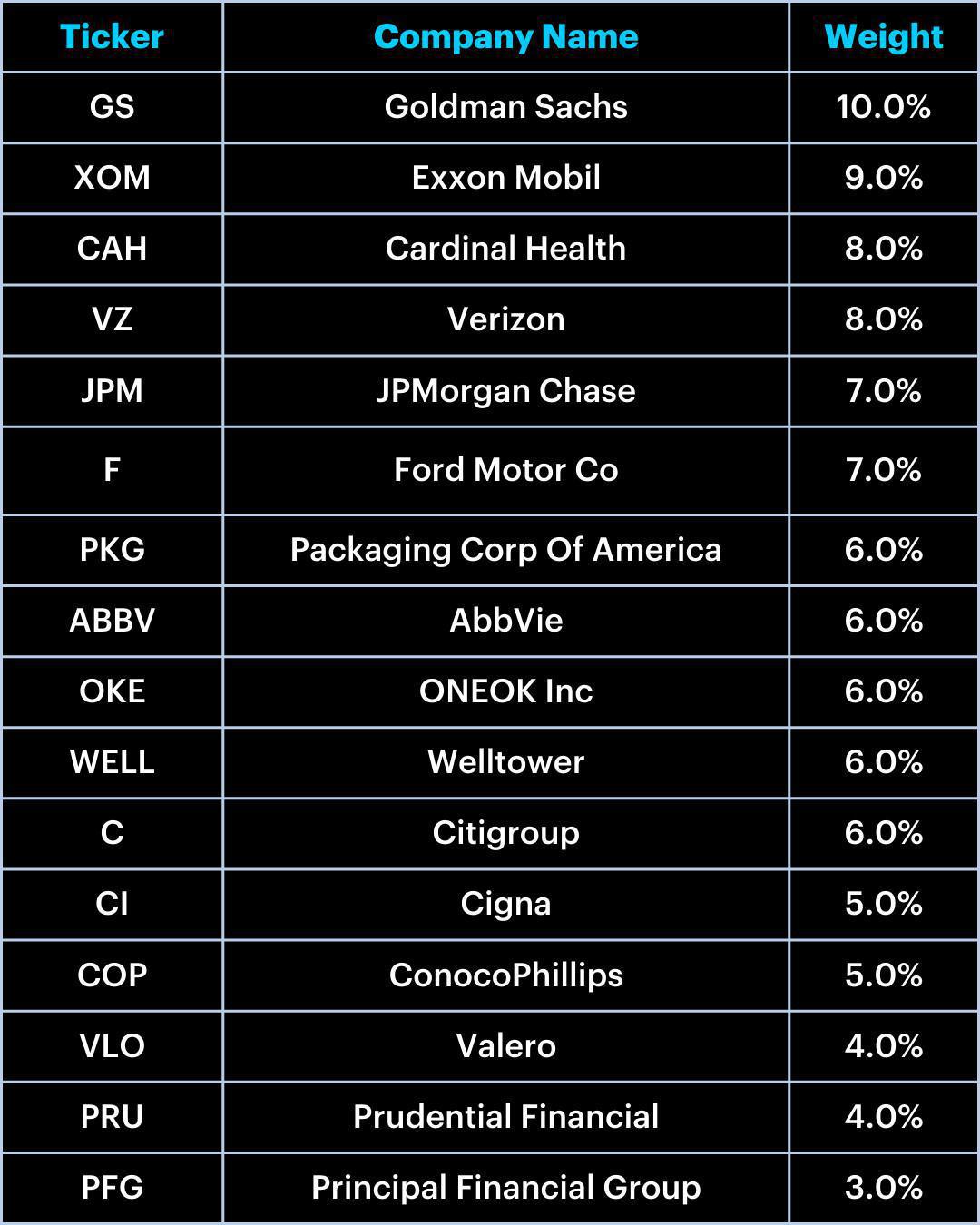

Old Portfolio:

-

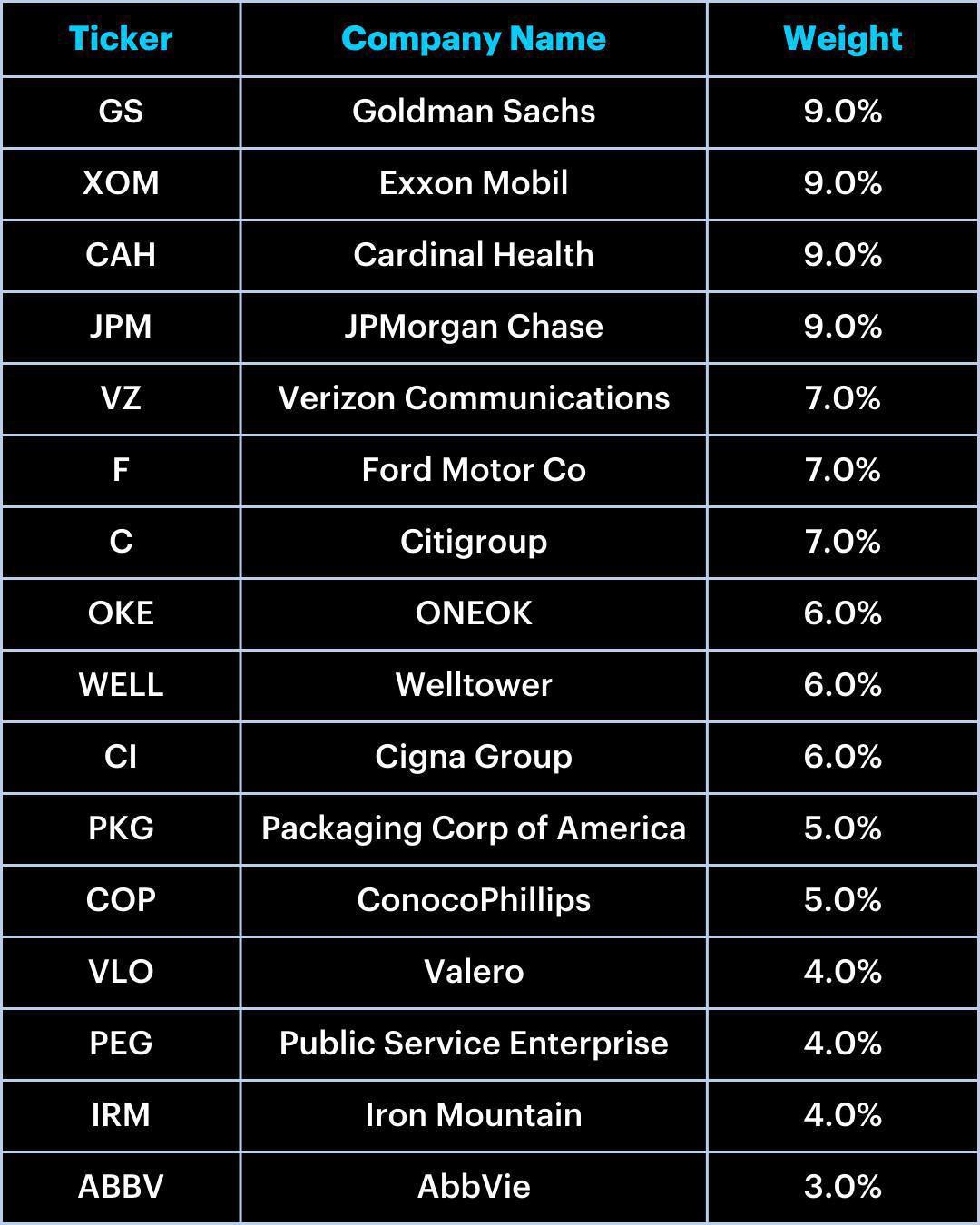

New Portfolio:

Changes:

This month, most of the changes came via the weightings albeit the algorithm made 6 wholesale changes.

It trimmed PRU & PFG, while adding PEG & IRM. We'll be back in a few months with updates as per usual.

If any questions arise, please reach out.

To see last month's trades and outperformance, just click: here