If you missed our last update, 2022 & 2023 were both model years for our ESG portfolio.

That's because in 2023 specifically, our ESG strategy blew the doors off with a whopping 27% return.

And while that's great for those of you who followed along, now midway through 2024, we now have a whole new host of challenges we need to be ready for.

So after several months of holding strong, we re-ran our algorithms and made some updates to our portfolio.

So with that context, let's get into the ESG portfolio's newest trades! 👇

ESG Overview:

Before we dive into our portfolio's updates, if you're new to this strategy then just click here for the original post or read the condensed version below.

If you already know about our ESG strategy, then just skip down to the section labeled, "Performance" below.

The goal of this strategy, however, is to invest in companies -- ethically. What does that mean?

Well, at a high level, ESG strategies help you invest in a way that reflects your values -- in a way that considers the impacts of the companies you invest in.

Therefore our ESG (Environmental, Social, and Governance) strategy is focused on investing in companies that are contributing to the positivity of the world as a whole.

In a nutshell, we're looking at three factors:

-

Environmental: This relates to a company’s negative environmental impacts, such as carbon emissions and other forms of pollution, but it also rewards companies for adopting greener technology.

-

Social: This relates to how committed a company is to social causes, like inclusion and the elimination of workplace discrimination.

-

Governance: This relates to the company’s corporate culture, executive pay, and corruption.

While the companies we're investing in need to have the right financials to merit an investment, they also need to pass this test to ensure their growth doesn't mean our "society's demise".

But if you're up to speed, let's get into the portfolio's performance and the newest updates!

Performance:

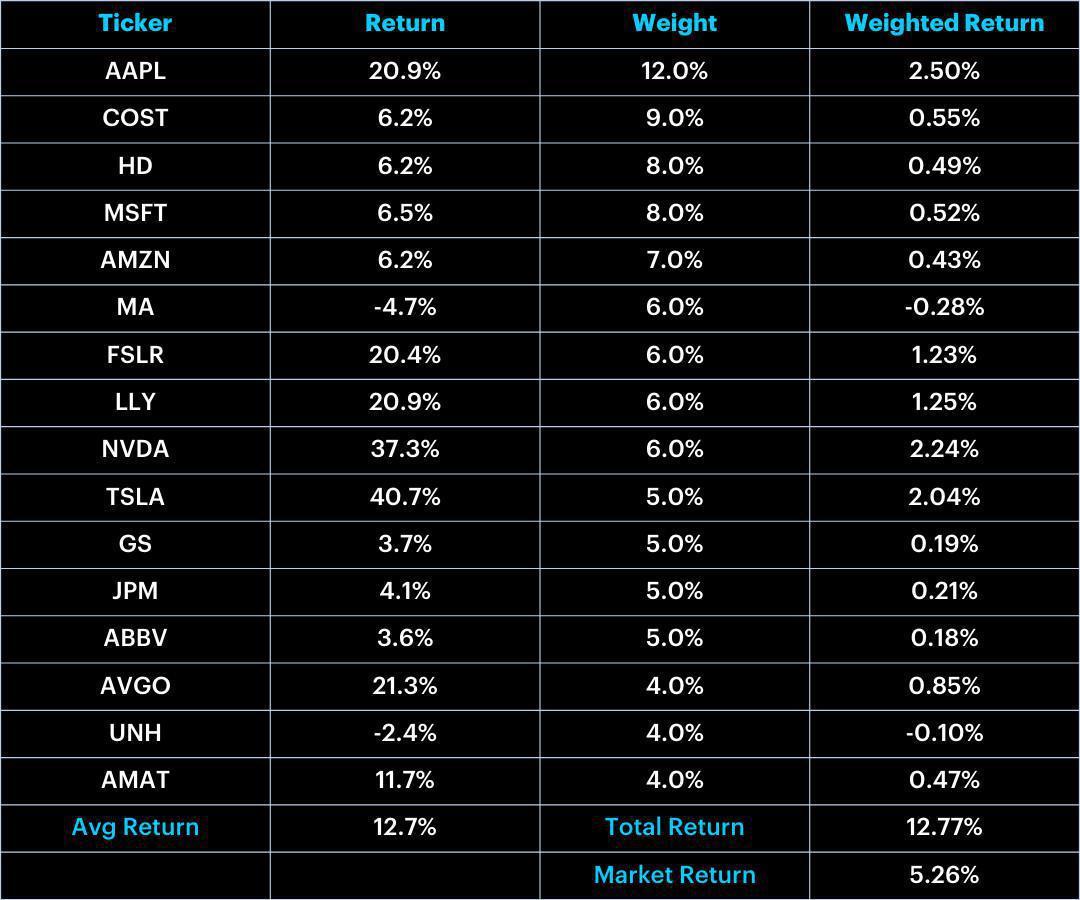

As we mentioned above, the portfolio has continued to outperform the index since inception. That's because the trend has continued with the total portfolio up 40% to start the year and 13% during this period!

And while the performance alone is great, we're even happier to announce that this portfolio is also beating the index while investing in "responsible companies". Aka we're investing in companies that are "helping the world" while also making money.

But what actually drove this period's performance? 👇

Looking at the table we can see that while performance was generally positive, there was a lot of variation from the average.

For example, TSLA & Apple returned 41% and 21%, respectively, while MA and UNH returned -4.7% and -2.4%, respectively.

At first glance, this may look pretty confusing as we see two patterns emerge.

-

The first one is that tech outperformed other sectors over the last rebalance period. This shouldn't come as a surprise given Jerome Powell's recent comments and what's going on at the Fed. Rates are anticipated to drop soon and there's hope on the horizon that it'll give a strong boost toward growth stocks.

-

The second is that stock selecton is becoming more and more important. Notice how UNH & ABBV performed vs. LLY. While this is something we've been preaching for a while, it may have fallen on deaf ears for many since investors over the last decade are used to just investing in top names and watching them rip higher. However in today's era, execution is more important than ever and we can see that clearly by just looking at the healthcare stocks within our portfolio.

At the end of the day, there's still a handful of other factors and we realize we're oversimplifying, but what we want you to take away is that bottom-up analysis is king right now.

While thematic investing is always important, we are mostly looking at companies from the bottom up rather than the top down.

If you want more insight into our process and what this all means, feel free to reach out!

If not, let's get into the updates.👇

Old Portfolio:

The only changes this month were the weightings with zero wholesale changes to the names within the portfolio themselves.

New Portfolio:

We'll see you again during the next re-balance period 😀

To see last month's trades, just click: here