Welcome back to another Moby Flagship Quantitative Dividend Portfolio update!

If you’re familiar with this strategy, feel free to skip ahead to the section labeled “Performance Review.”

If you’re new here, the goal of this portfolio is simple: generate steady, above-market income through dividends — while still leaving room for capital appreciation. We do this by investing in companies with strong balance sheets, reliable free cash flow, and a proven history of paying (and ideally growing) their dividends.

Since our last update, the market has gone through its usual mix of rotation, noise, and macro drama. But while tech stocks were grabbing headlines, dividend stocks quietly continued to do their job — delivering consistent income with lower volatility.

This update reflects that. Our portfolio delivered solid results, with several names outperforming expectations and a few that didn’t quite keep pace. We’ve made a few adjustments to reflect changes in macro conditions, dividend coverage, and growth outlook — and we’ll walk you through those changes below.

Here’s what we’ll cover today:

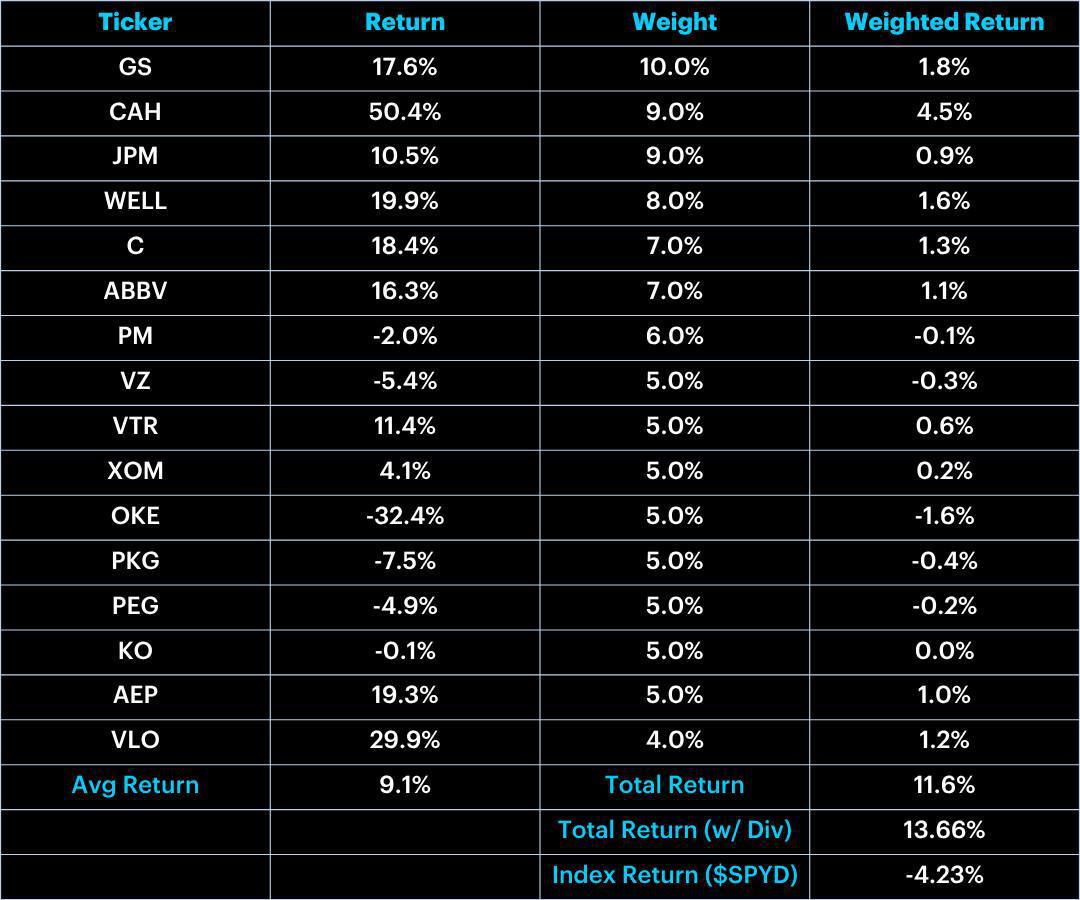

- How the portfolio performed

- Which stocks helped — and which didn’t

- What we’re changing and why